Overview

Public blockchains like Ethereum provide an ideal infrastructure for the development and operation of AI agents, due to their distinctive features that align perfectly with the needs of decentralized, autonomous systems. These platforms not only support but enhance the capabilities of AI agents, fostering a new era of technological integration that could reshape societal and economic structures. Let’s explore why blockchains are the prime stage for AI’s evolution and the profound benefits they offer.

Davide Crapis wrote an excellent article on the role of AI agents in blockchain1. I will refer the user to follow this article for a more non-technical introduction to the topic.

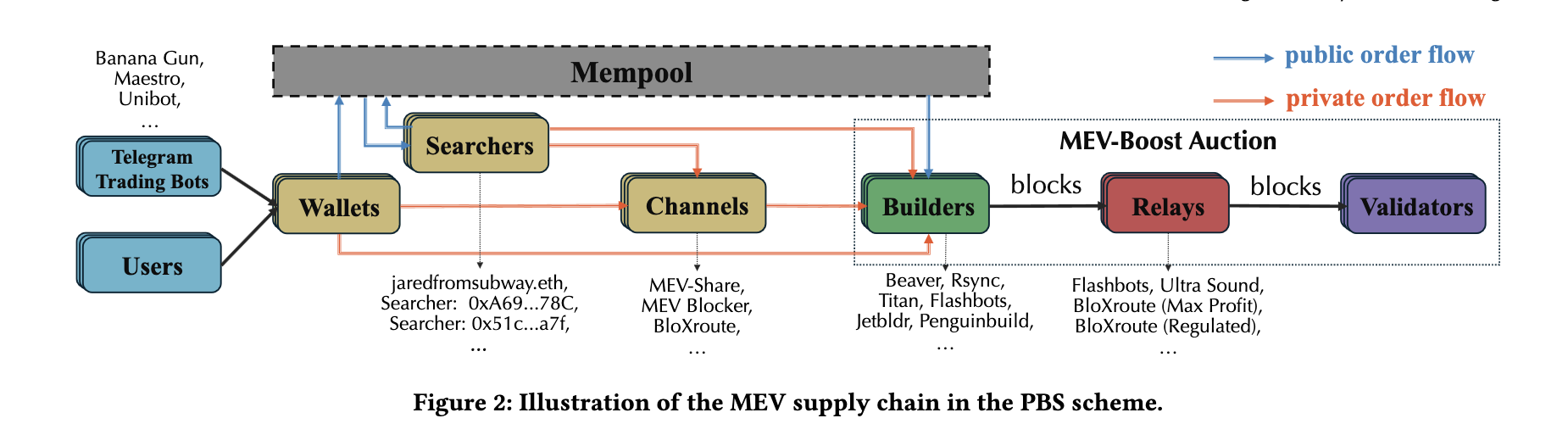

In this article I will develop some ideas on how to explore this design space of AI agents and their orchestration mechanism and how these AI agents can be designed in the current Miner Extractable Value (MEV) supply chain architecture in the current Proposer Builder Separation (PBS) scheme to bring out the true potential of AI in Ethereum blockchain infrastructure.

I have written about PBS and MEV in my ePBS article. If you are new to these topics, you may want to start here.

Strategic Benefits of AI in Blockchains

The convergence of blockchain technology and AI is paving the way for advanced, decentralized systems that promise to revolutionize digital interactions. Here are the unique characteristics of blockchains that make them an excellent platform for AI agents and the transformative benefits this integration offers for societal, economic, and technological advancements.

- Decentralization: Blockchains like Ethereum are inherently decentralized, preventing any single entity from controlling the network, ideal for unbiased AI operations.

- Incentives: Blockchains support complex incentive structures with native assets and smart contracts, enabling diverse economic models for AI interactions.

- Openness and Composability: Anyone can participate and develop applications on blockchain platforms, allowing seamless interaction between applications.

- Cryptographic Guarantees: Advanced cryptography ensures unparalleled security and privacy for AI operations, from transaction security to privacy-preserving computations.

- Alignment: Blockchain’s transparency helps align AI behaviors with human values through trackable and visible activities.

- Safety: The secure nature of blockchains is suited for deploying AI in high-risk environments, ensuring reliability.

- Discovery: The openness of blockchain allows AI agents to be discoverable and utilized based on reliable reputations, documented immutably.

- Efficiency: Blockchains reduce the need for intermediaries, enabling autonomous agents to perform transactions and interactions swiftly and cost-effectively.

- Control and Programmable Privacy: Individuals can control their AI agents and personal data securely through blockchain’s cryptographic solutions.

- Ownership and Fairness: Blockchains facilitate new forms of collective ownership and governance, such as DAOs, promoting democratic decision-making and fair value distribution.

- Future Integration: Advanced stages of AI and blockchain integration will likely lead to sophisticated AI marketplaces and operational frameworks, enhancing service efficiency and effectiveness.

- Scalable Models for Governance: Models like direct ownership and DAOs offer flexible and inclusive ways to manage AI systems, ensuring fair governance and distribution.

Revolutionizing AI Agents in MEV Supply Chain Management

Figure: MEV supply chain in the PBS. Credit by Sen Yang, arXiv:2405.01329 [cs.CR]

By integrating AI into Ethereum blockchain environments, particularly in managing the MEV supply chain in the current PBS scheme, we can address complex challenges and enhance the efficiency and security of blockchain operations. Here’s a detailed exploration of some innovative AI-driven applications designed to optimize the blockchain landscape.

Below I will explore high level overview of some problems in the MEV supply chain architecture and how to build coordination and collaboration games using AI agents to solve these challenges. In the future articles, I will develop these problems further to understand their design space, mechanism designs, value creation, AI methodlogy and implementation details.

Privacy-Preserving Real-Time Auction System for Ethereum Block Space Allocation

In Ethereum MEV auctions for block space, maintaining bidder privacy is crucial. But in the current MEV-Boost architecture such guarantees are weak. AI agents using Secure Multi-Party Computation (SMPC) or Fully Homomorphic Encryption (FHE) can manage encrypted bids to prevent exposure and manipulative behaviors. These AI systems ensure that only the auction system knows the true bid values (in the worst case), enhancing both the privacy and fairness of auctions.

Problem Statement:

Securely conducting auctions for a block space allocation without exposing sensitive bid information to maintain bidder privacy and prevent manipulative behaviors.

Technical Approach:

Deploy AI agents that utilize Secure Multi-Party Computation (SMPC) or FHE to handle bids. AI algorithms process encrypted bids, ensuring that bid values are only revealed to the auction system (in the worst case) and not to other bidders.

Mechanism Design:

- $B = ${ $b_1, b_2, …, b_n$ } represents a set of bids.

- AI agents compute $max(B)$ in a privacy-preserving manner.

- Ensure that $\forall b_i \in B$, data is encrypted and secure.

Data Required:

Encrypted bids for the block, Relay APIs auction data, Ethereum transaction data for verification post-auction.

Evaluation Criteria:

- Bid privacy preservation.

- Auction fairness and transparency.

- Time to finalize auction results.

Optimization Potential:

Refine cryptographic techniques and multi-round auction mechanism designs to reduce computational overhead and improve auction performance.

AI-Coordinated Block Construction within Fixed Time Slots

AI agents can dramatically improve how transactions are packaged into a block and ordered within Ethereum’s 12-second block time. By analyzing pending transactions in the mempool, these agents maximize network fees and optimize block space utilization, boosting overall network throughput.

Problem Statement:

To maximize block value and network throughput, the inclusion of transactions within Ethereum’s 12-second block time must be optimized by carefully balancing private data pools and public mempools.

Technical Approach:

- AI Agents:

AI agents dynamically analyze and order transactions from both private data pools and public mempools to optimize network fees and efficiently utilize block space.

Mathematical Model:

- Transaction Sets:

Let $T_{PA}$ represent the private data transaction pool and $T_{PB}$ represent the public mempool transactions. - Optimization Function:

$f(B) = \max\left(\sum_{t \in T_{\text{PA}}} \text{fees}(t) + \sum_{t \in T_{\text{PB}}} \text{fees}(t)\right),$ where B is the block to be filled, $T_{PA}$ and $T_{PB}$ are the private and public pools of transactions to be included respectively, and $fees(t)$ is the transaction fee for a given transaction $t$.

Constraints:

The optimization must comply with block size and time constraints.

Mechanism Design:

-

Define Transaction Set:

Identify the optimal transaction set, $T$, within a block, $B$. -

Optimize BB:

Implement an AI system that learns patterns in real-time mempool data and historical block data to select and order transactions that maximize network fees and efficiently utilize block space.

Data Requirements:

- Real-time mempool data and private providers data.

- Historical block data for training and optimizing the AI agents’ decision-making processes.

Evaluation Criteria:

-

Block Space Utilization:

Measure how effectively the AI agents fill the block space with high-fee transactions. -

Transaction Throughput:

Determine the total number of transactions processed per block. -

Average Block Propagation Time:

Evaluate the time it takes for a new block to propagate through the network.

Optimization Potential:

- Learning Algorithms:

Implement adaptive learning algorithms that react to changing network congestion and transaction fee dynamics. - Performance Metrics:

Continuously refine AI agents’ transaction selection strategy based on collected performance metrics.

Integration of Real-Time Off-Chain Data for Enhanced On-Chain Decision Making

Incorporating off-chain data like market trends and economic indicators can significantly enhance on-chain decision-making. AI-driven systems process this real-time data, allowing smart contracts to dynamically adjust strategies based on external economic conditions.

Problem Statement:

Enhancing on-chain trading decisions and strategies by integrating real-time data from off-chain sources, such as centralized exchanges, social media, and economic indicators.

Technical Approach:

- AI Processing:

Utilize AI to analyze and process off-chain data feeds in real-time. These AI models integrate insights directly into smart contracts, enabling dynamic and responsive decision-making on the blockchain.

Mechanism Design:

- Data Integration:

Let $D$ represent the set of validated data points gathered from various off-chain sources. - AI Model Predictions:

AI models predict the potential impacts of off-chain data on on-chain actions and dynamically recommend strategies.

Data Required:

- Real-time price feeds from various financial markets and cryptocurrency exchanges.

- Social media trends that could indicate shifts in trader sentiment.

- Economic indicators that could affect market conditions.

Evaluation Criteria:

- Prediction Accuracy:

Evaluate how accurately the AI models predict market movements based on off-chain data. - Responsiveness:

Measure the system’s speed in responding to real-time data changes. - Trading Efficiency and Profitability:

Assess the impact of data-driven decisions on trading efficiency and profitability.

Optimization Potential:

- Data Processing Enhancements:

Improve data fetching and processing algorithms to minimize latency and maximize data throughput. - Model Refinement:

Continuously refine AI models to enhance prediction accuracy and responsiveness to market dynamics.

Specific Objectives and Examples

Automated Risk Management:

- Objective: Minimize losses by automatically adjusting on-chain trading positions in response to sudden changes in market conditions detected through off-chain economic indicators.

- Example: If sudden economic downturns are detected through off-chain feeds, AI models could automatically initiate hedging strategies on-chain to protect investments.

Dynamic Pricing Models:

- Objective: Utilize real-time price feeds from multiple exchanges to adjust on-chain asset prices dynamically.

- Example: Automatically adjust the pricing of tokenized assets on decentralized exchanges based on real-time data from centralized financial systems.

Sentiment Analysis Driven Trading:

- Objective: Leverage social media trends to gauge market sentiment and predict market movements.

- Example: Use sentiment analysis on Twitter data to anticipate significant cryptocurrency buy or sell-offs, enabling preemptive on-chain strategy adjustments.

Economic Impact Forecasting:

- Objective: Predict the on-chain impact of major economic announcements and integrate these forecasts into trading strategies.

- Example: Before the release of major economic reports (like GDP growth rates, interest rates, etc.), AI models could predict potential market reactions and adjust on-chain-based DeFi products accordingly.

Off-Chain Computation for On-Chain Efficiency

AI can also reduce the computational load on the blockchain. By performing complex calculations off-chain and then integrating the results back on-chain using cryptographic proofs and cryptoeconomic ecurity mechanisms like EigenLayer2 and Ritual3, we reduce transaction costs and enhance overall network performance.

Problem Statement:

Mitigate the high computational load and costs associated with complex on-chain operations by leveraging AI-driven computation off-chain, while ensuring the integrity and verifiability of these computations when reintroduced on-chain.

Technical Approach:

- Hybrid Architectures:

Implement hybrid architectures where AI agents perform heavy computations off-chain. These computations are then verified and integrated on-chain using specialized protocols such as EigenLayer AVS 2 or Ritual 3, which provide additional cryptoeconomic assurances.

Mechanism Design:

- Off-Chain Computation:

Conduct compute-intensive tasks $C$ off-chain using AI agents. - Cryptographic Verification:

Utilize cryptographic proofs (like zero-knowledge proofs or TFHE) to verify the integrity of $C$’s results when submitted on-chain.

Data Required:

- Data specific to the computational tasks being offloaded, including parameters needed for AI model training and operation.

Evaluation Criteria:

- Cost Reduction:

Measure the reduction in on-chain transaction costs resulting from offloading computations. - Verification Success Rate:

Evaluate the success rate of verifying off-chain computation results on-chain. - Network Performance Improvement:

Assess overall network performance improvements.

Optimization Potential:

- Enhancing Cryptographic Proofs:

Develop more efficient cryptographic proofs to enhance security and feasibility of integrating off-chain computations.

Specific Objectives and Examples

Decentralized AI Training:

- Objective: Perform intensive AI model training off-chain to reduce costs and then use cryptographic proofs to verify the model’s integrity on-chain.

- Example: Train a complex neural network model to predict market trends based on large datasets off-chain. Use zero-knowledge proofs to verify the model’s accuracy and integrity when deploying it on-chain for decentralized financial forecasting.

Enhanced Data Privacy:

- Objective: Utilize off-chain computation to process sensitive data, ensuring privacy is maintained when results are used on-chain.

- Example: Process personal financial data off-chain for credit scoring while maintaining individual privacy. Verify the computation’s integrity on-chain using Ritual.net to maintain data confidentiality and ensure result reliability.

Resource-Intensive Simulations:

- Objective: Conduct resource-intensive simulations, like environmental impact assessments, off-chain to avoid overloading the blockchain.

- Example: Simulate complex environmental models off-chain using AI. Use EigenLayer AVS to validate and relay the simulation results to the blockchain for transparent and secure public access.

Scalable Machine Learning Models:

- Objective: Scale complex machine learning models by handling the bulk of computational work off-chain.

- Example: Develop large-scale machine learning models for genomic data analysis off-chain. Implement cryptographic protocols to ensure that the findings are verifiable on-chain without exposing the sensitive data.

Dynamic Trade Routing in MEV Scenarios

During periods where MEV is detectable, AI agents can route transactions through optimal pathways to minimize costs and slippage. By continuously learning from the network state, these agents adapt and optimize the routes in real time.

Problem Statement:

Optimize the efficiency and profitability of trade executions in blockchain environments by dynamically routing transactions through the most advantageous paths during MEV opportunities.

Technical Approach:

- AI-Driven Routing:

Employ AI agents to analyze both current and predictive market states to route transactions dynamically. These agents minimize transaction slippage while maximizing returns, akin to how robo-advisors manage portfolios in traditional finance.

Mechanism Design:

- Graph-Based Modeling:

Construct a graph $G$ where nodes represent possible transaction paths, and edges reflect the costs associated with each path. - Cost Minimization:

Use AI-driven predictive analytics to minimize the path cost, optimizing the route for each transaction based on real-time and historical data.

Data Required:

- Real-time and historical MEV data.

- Transaction cost metrics.

- Network latency measurements.

Evaluation Criteria:

- Trade Execution Success Rate:

Track the effectiveness of transaction routing in achieving optimal execution. - Reduction in Transaction Costs and Slippage:

Measure improvements in cost-efficiency and reduced slippage due to optimized routing. - User Satisfaction and System Adoption:

Assess user satisfaction with the system’s performance and its adoption rate among users.

Optimization Potential:

- Continuous Model Tuning:

Regularly update AI models with incoming data to refine route prediction accuracy and adapt to changing network conditions.

Specific Objectives and Examples Inspired by TradFi Robo-Advisors

Automated Portfolio Rebalancing:

- Objective: Implement AI systems that adjust blockchain-based asset holdings in response to shifting MEV landscapes, similar to how TradFi robo-advisors rebalance portfolios based on market changes.

- Example: An AI system might automatically shift a user’s transaction pathways between different DeFi protocols to take advantage of lower transaction fees or higher yield opportunities as they arise.

Tax-Loss Harvesting:

- Objective: Adapt the concept of tax-loss harvesting from TradFi to blockchain transactions to optimize the tax implications associated with trading and swapping digital assets.

- Example: Develop an AI mechanism that identifies opportunities to realize losses on digital asset transactions strategically, thereby minimizing taxable gains in a user’s cryptocurrency portfolio.

Cost-Effective Trade Execution:

- Objective: Minimize transaction costs by selecting paths that avoid high gas fees and poor trade execution times, much like how TradFi platforms find the best trade execution routes to save costs.

- Example: An AI system dynamically routes a trade through a series of decentralized exchanges (DEXs) or L2s that offer the lowest slippage and gas fees at the moment of transaction.

Dynamic Slippage Management:

- Objective: Manage slippage in high-volatility environments by using predictive analytics to choose the best times and routes for executing large transactions.

- Example: Before executing a large trade, the AI evaluates potential slippage across various DEXs or L2s and routes the transaction through the path that minimizes impact on market prices, similar to how large block trades are managed in stock markets.

AI-Powered MEV Supply Chain Management

Streamlining the MEV supply chain involves managing the flow of transactions efficiently from wallets to proposers. AI agents orchestrate this flow, ensuring that transactions are bundled appropriately and sent to the most suitable builders based on current network conditions.

Problem Statement:

Streamline the MEV supply chain by optimizing the flow of transactions from wallets to proposers, reducing inefficiencies and maximizing profitability.

Technical Approach:

- AI Orchestration:

Deploy AI agents to manage the flow of transactions, ensuring they are efficiently bundled and directed towards the most suitable builders based on current network conditions and available MEV opportunities.

Mechanism Design:

- Transaction Set Ω:

Consider $\Omega$ as the complete set of transactions from initiation to block inclusion. - Optimization Process:

AI optimizes the routing for each transaction $\omega \in \Omega$ to maximize efficiency and profit.

Data Required:

- Transaction origin data.

- Real-time network state.

- Builder performance metrics.

Evaluation Criteria:

- Supply Chain Efficiency:

Assess the overall efficiency of the transaction supply chain. - Reduction of Orphaned Transactions:

Measure the decrease in transactions that fail to be included in blocks. - Profitability from MEV Extraction:

Evaluate the increase in profits derived from optimized MEV extraction.

Optimization Potential:

- Dynamic Orchestration Logic:

Continuously adapt the transaction routing and builder selection logic based on real-time feedback and changing network conditions.

Specific Objectives and Examples

Intelligent Builder Recommendation System:

- Objective: Implement a recommendation engine that matches transactions with builders who offer the best efficiency and profit potential based on historical and real-time data.

- Example: An AI system analyzes past performance data of builders and current transaction characteristics to recommend a builder that is most likely to maximize MEV for specific transactions.

Dynamic Transaction Routing:

- Objective: Dynamically route transactions through the MEV supply chain, adjusting paths in real-time to respond to network congestion and gas price fluctuations.

- Example: AI agents monitor the state of the network and reroute transactions through channels that minimize costs and optimize block space utilization, similar to how network traffic is managed in data networks.

Predictive MEV Opportunities Identification:

- Objective: Use predictive analytics to forecast upcoming MEV opportunities and preemptively position transactions to capitalize on these events.

- Example: An AI system forecasts potential arbitrage opportunities from price discrepancies across different decentralized exchanges and automatically queues transactions to exploit these discrepancies.

Performance-Based Builder Ranking:

- Objective: Rank builders based on their performance metrics such as success rate, average MEV profit generated, and reliability.

- Example: AI analyzes performance data to create a dynamic leaderboard of builders. Transactions are then preferentially routed to top-ranked builders to enhance overall supply chain profitability.

AI-Driven Block Building Simulation for Optimal Bidding Strategies

AI can simulate various block-building strategies in a virtual environment. This allows for testing and optimization of strategies without risking live network stability, leading to more effective and efficient blockchain operations.

Problem Statement:

Create a simulation environment that allows for the experimentation and optimization of various block building strategies to enhance efficiency and profitability without impacting the live blockchain network.

Technical Approach:

-

Virtual Blockchain Environment:

Develop a simulated blockchain environment where AI agents can safely experiment with various block building scenarios, including different bidding strategies. -

AI-Driven Simulations:

Utilize AI to control and adjust the simulation, testing different strategies and their outcomes under a variety of network conditions.

Mechanism Design:

-

Network Simulation $N$:

Simulate a blockchain network with variable conditions to mimic real-world scenarios. -

Experimentation with Block Proposals $\Pi$:

AI experiments with different block proposal strategies to identify those that maximize efficiency, profitability, and other relevant output metrics.

Data Required:

- Historical blockchain data to establish baseline behaviors and trends.

- Transaction datasets to populate the simulation with realistic activities.

- Network performance metrics to analyze the impact of different strategies on network efficiency and block propagation.

Evaluation Criteria:

-

Simulation Accuracy:

Measure how closely simulation predictions align with real-world data. -

Strategy Improvement:

Assess the effectiveness of various strategies in improving block building outcomes. -

Adoption Potential:

Evaluate the potential for network participants to adopt the optimized strategies developed in the simulation.

Optimization Potential:

- Model Refinement:

Continuously refine simulation models and integrate more real-time data to align more closely with actual network conditions.

Specific Objectives and Examples

Naive Strategy Simulation:

- Objective: Evaluate the performance of a simple first-come, first-served block building strategy under varying network conditions.

- Example: Simulate how a naive strategy performs during high and low transaction volumes, assessing its impact on block utilization and miner rewards.

Adaptive Strategy Development:

- Objective: Develop an adaptive strategy that dynamically adjusts based on real-time network conditions and transaction pool characteristics.

- Example: Use AI to simulate and refine a strategy that changes bidding behavior based on gas prices, transaction sizes, and expected MEV to maximize profitability.

Last-minute Strategy Analysis:

- Objective: Test the effectiveness of last-minute bidding strategies in securing more valuable transactions near the end of a block time window.

- Example: Simulate scenarios where builders wait until the last moment to submit bids, aiming to capture late-breaking, high-value transactions.

Bluff Strategy Evaluation:

- Objective: Assess the risks and rewards of bluff strategies where builders simulate interest in certain transactions to manipulate other builders’ behavior.

- Example: Implement a bluff strategy in the simulation to see how it affects the bidding behavior of competitors, particularly in MEV-rich environments.

NLP and LLM for Simplified MEV Interaction

Implementing natural language processing (NLP) and Large Language Model (LLM) systems can make interacting with Ethereum more accessible. Users can input commands in natural language, which are then translated into actionable functions or structured queries, simplifying the user experience.

Problem Statement:

Enhance the accessibility of blockchain and MEV-related systems by implementing a natural language interface that converts user commands into specific, executable blockchain actions.

Technical Approach:

-

NLP System Implementation:

Develop an AI-powered NLP/LLM system that can understand and process natural language queries from users and translate these into smart contract functions or transaction instructions. -

AI Translation Models:

Utilize advanced NLP models that can interpret the intent and details of user commands, converting them into the appropriate blockchain operations.

Mechanism Design:

-

NLP Models $M$:

Build and train NLP models to comprehend and execute complex blockchain commands from natural language inputs. -

User-Blockchain Interface $I$:

Create an interface that acts as a bridge between user inputs and blockchain actions, facilitating the translation of natural language into smart contracts and transactions.

Data Required:

- User input data to train the NLP models on typical user queries.

- Common transaction templates that represent frequent blockchain operations.

- Language model training sets to improve the NLP model’s understanding of blockchain-specific terminology and operations.

Evaluation Criteria:

-

Ease of Use and Accessibility:

Assess how the NLP system improves the user experience in interacting with blockchain systems. -

Accuracy of Command Translation and Execution:

Measure the precision with which the NLP system interprets and executes user commands. -

User Engagement and System Throughput:

Evaluate user adoption rates and the efficiency of the system in handling multiple simultaneous queries.

Optimization Potential:

- Expansion of Language Models:

Continuously enhance the NLP models to cover a broader range of queries and improve contextual understanding to better handle complex and nuanced user requests.

Specific Objectives and Examples

Simple Transaction Commands:

- Objective: Allow users to perform basic transactions like buying tokens using straightforward commands.

- Example: A user says, “I want to buy 500 units of token ABC at a price not higher than $20 each,” and the system translates this into a corresponding smart contract function that monitors prices and executes the buy order within the specified constraints.

Investment Planning Commands:

- Objective: Enable users to set up complex, conditional investment plans through conversational input.

- Example: A user specifies, “I want to invest $1,000 per month into Ethereum Layer 2 projects over the next six months,” and the AI system schedules and manages these investments as requested.

Staking and Delegation Commands:

- Objective: Facilitate the configuration of staking and delegation preferences via natural language.

- Example: A user commands, “I want to restake my $ETH with EigenLayer and delegate it to AVSs, aiming for an APR of at least 10% and a risk factor below 5%,” and the NLP system sets up the staking according to these parameters.

Advanced Configuration for Solo-Builders:

- Objective: Allow solo builders to configure and deploy smart contracts or engage in sophisticated MEV strategies using conversational language.

- Example: A builder might specify, “Deploy a contract that arbitrages across DEXs when the price differential exceeds 0.5%,” and the NLP interface would translate this into a smart contract setup.

Complex Strategy Formulation for Sophisticated Builders:

- Objective: Facilitate the development of complex trading and investment strategies through detailed natural language instructions.

- Example: A sophisticated builder could instruct, “Create a dynamic hedging strategy that adjusts based on real-time gas prices and token volatility indices,” and the system would translate this into a series of smart contract functions.

Decentralized AI Marketplaces for Dynamic MEV Strategies

Creating decentralized marketplaces for AI-driven MEV strategies can foster a robust trading environment. Here, strategies are tokenized and traded securely, with smart contracts ensuring transaction integrity and compliance.

Problem Statement:

Develop a decentralized platform where users can exchange AI-driven MEV strategies securely and transparently, facilitating an efficient market for cutting-edge on-chain trading technologies.

Technical Approach:

-

On-Chain Marketplace:

Construct a marketplace on the on-chain where AI-generated MEV strategies are tokenized, allowing for secure and transparent trading among participants. -

Smart Contract Integration:

Implement smart contracts to handle the creation, trading, and execution of strategy tokens, ensuring transaction integrity and providing mechanisms for dispute resolution.

Mechanism Design:

-

Market Structure (S):

Design a market structure that supports secure transactions of strategy tokens $\tau$, utilizing on-chain technology for enhanced security and transparency. -

Smart Contract Enforcement:

Use smart contracts for enforcing transactions, handling disputes, and managing the lifecycle of each strategy token.

Data Required:

- Detailed performance data for each strategy to inform potential buyers.

- User ratings and reviews to foster trust and transparency.

- Comprehensive transaction histories to ensure traceability and accountability.

Evaluation Criteria:

-

Market Liquidity and Volume:

Evaluate the fluidity of the marketplace and the volume of transactions to ensure a healthy trading environment. -

User Satisfaction and Trust:

Measure user satisfaction and trust in the marketplace through surveys and engagement metrics. -

Regulatory Compliance and Security:

Assess compliance with relevant regulations and the security of transactions within the marketplace.

Optimization Potential:

- Feature Updates and UI Enhancements:

Regularly update marketplace features and user interfaces based on user feedback and emerging market trends to enhance usability and functionality.

Specific Objectives and Examples

Specialized Prediction Markets Driven by AI Agents:

- Objective: Develop prediction markets where AI agents continuously analyze and update the likelihood of various MEV scenarios, creating a dynamic market for betting on these outcomes.

- Example: AI agents operate a prediction market for the next block’s MEV opportunities, allowing users to place bets based on AI predictions of likely scenarios.

AI-Driven Strategy Development and Tokenization:

- Objective: Enable AI systems to develop and refine MEV strategies, which are then tokenized and sold on the marketplace.

- Example: An AI system creates an advanced arbitrage strategy for decentralized exchanges, which is tokenized as a digital asset. Users can buy, sell, or license this strategy through smart contracts.

User-Driven Strategy Customization and Trading:

- Objective: Allow users to customize existing AI strategies and trade these modifications in the marketplace.

- Example: A user modifies an AI-generated strategy to better suit their specific trading style and risk tolerance, then sells the improved strategy as a unique token on the platform.

Regulatory and Compliance Monitoring Tools:

- Objective: Incorporate tools that monitor and ensure compliance with financial regulations within the marketplace.

- Example: Implement AI-driven monitoring systems that automatically check all strategy tokens against regulatory requirements and flag potential issues.